SDSE: Catalyst of the Future of Our Economy?

Let me begin this article by providing a rundown of the SDSE. The SDSE (SimDemocracy Stock Exchange) is an independent project where entrepreneurs and investors can trade public business stocks.

The SDSE was created during a time when the economy was stagnant, lacking the mobility and monetary flux that stable economies rely on, as per the words of u/frisianoutlaw – a major investor and founder of the SDSE.

With few outlets for spending available, people turned to entrepreneurship and high-risk ventures like gambling, but for those seeking structured, long-term investment opportunities, SDSE provided a new, organized alternative

The economy is always shifting, reflecting the constant change of power in government leadership and workforce. While new taxation policies have been introduced to stabilize revenue streams, the SDSE remains largely untouched by regulatory oversight. The question now is whether the SDSE can prove itself to become an essential pillar of the economy, or will remain a side project hindered by the various fiscal problems our democracy faces—a question I hope to answer by the end of this article.

A major detail I pointedly did not mention earlier in my explanation of the SDSE is that the SDSE has, as of the writing of this article, no government regulations imposed on it. Unlike other sources of revenue, which are subject to taxation, such as wages and personal income—the SDSE remains untouched by government oversight.

This regulatory gap is significant because, while taxation and oversight can provide stability, they also introduce friction that discourages investment. SDSE’s current freedom from government intervention gives it a special opportunity to grow dynamically; provided it can gain the public’s trust.

Moreover, this also raises questions about the SDSE’s long-term role in the economy. To explore this point further, let’s consider both the opinions of investors and the insight of the government through its financial policies.

Advertisement

You might believe that the SDSE is too young and undeveloped to rely on or even pursue in terms of financial reserves, but in the eyes of many investors: the SDSE is growing sustainably. Every week, stocks are exchanged and new businesses are listed to the public. This is NOT a call for you to go spend your life savings on stocks; far from it actually, as the stock exchange is misunderstood by many and underplayed.

Nf19_1, a lawyer and investor whom I interviewed for his broad knowledge of the market, believes that the stock exchange is perceived by many as a game of fate. Buy low, sell high—just like the roll of dice; however, Nf19_1 argues that the market follows patterns that need to be analyzed and leveraged. Nf19_1 is also one of the few that recognize the real obstacle that faces the SDSE: financial engagement is not yet an essential part of life.

Stock investments rely on confidence – that is a fact known by many. Where brokers like Nf19_1 identify profitable opportunities in companies like SimDem Today and GatoPoll, other people remain dormant. The lack of public interest in finance means that SDSE’s influence is of limited reach.

And why is that a problem per se? Without active engagement, the market risks stagnation. This economic stagnation will not only be a failure of the SDSE itself but rather a sign that financial literacy and economic participation must be encouraged. This is the problem that started the SDSE in the first place and the reason why I stated that it may persist. The challenge, the main obstacle that lies in front, is to connect those who see the value of the SDSE and those who do not.

What is the role of the government in this? The government’s economic strategy indirectly supports SDSE’s growth by focusing on stability and self-actualization. Recently, the Senate introduced the Government Bond Expansion Act. To spare you the technical details, which you can obtain by reading the Act, this legislation defines the various forms of government bonds provided. By giving the Treasury the ability to issue the different types of bonds at need, this act births a new avenue for investment.

And how does the SDSE relate to bond expansion? Well, a bond market could integrate seamlessly with the stock exchange. Bonds and stocks are different at their core and they serve different purposes but they provide complementary roles. Bonds provide economic stability, while stocks drive growth.

Markets with both stocks and bonds tend to have more mature economies. For example, in the real world, you have the U.S. Treasury and Wall Street, the London Stock Exchange, and government gilts. Many examples worldwide can prove and assert that bonds and stocks coexisting can enhance a country’s financial stability.

One might argue that what differentiates us from the examples I gave above is that, in the real world, there is a need for money—there is a desire to obtain money on a large scale that is not present in a simulation. However, that assumption overlooks a crucial factor: the role of structured financial systems in shaping economic behavior.

Even in a simulation of a democracy, where basic survival does not hinge on wealth, incentives, or competition – investment still drives economic activity. The absence of necessity does not eliminate the demand for a stock exchange, it merely transforms it shifting the focus from survival, or what you can perceive as survival, to influence, growth, and financial incentive.

But is the economy really in such dire need of the stock exchange? To be more clear—how is the economy performing? Is the government able to control and manage its finances in a self-sufficient and efficient manner?

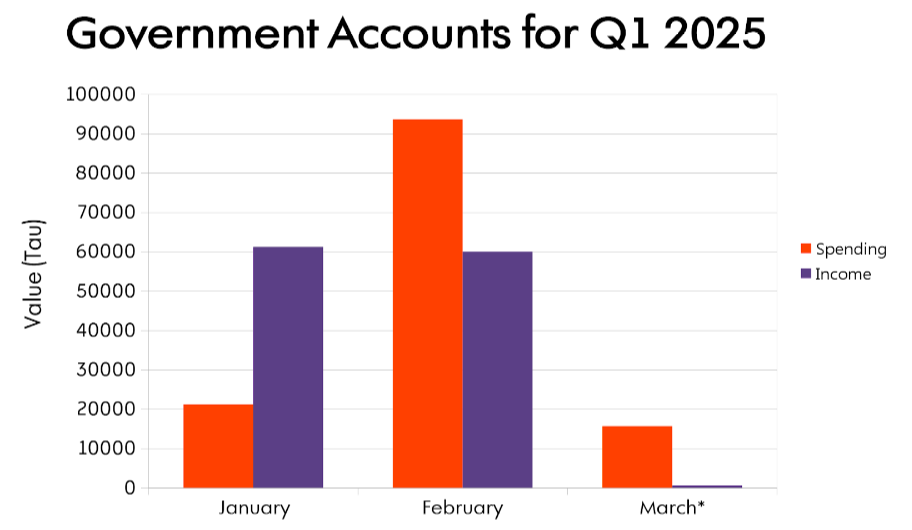

If we were to describe the data above, it would be clear that the government's accounts are fluctuant in their current state. January saw significant income outweighing spending, but by February the government’s expenses had skyrocketed. March, though incomplete in records, suggests a sharp decline in income revenue.

The structural weaknesses present in the Treasury have been highlighted by both Secretary of Treasury Matt Cheney, and his predecessor, FLY GUY 215, who voiced his thoughts and experiences in a similar article here. The focus of the Treasury at the current time is to lay out the foundation upon which to develop the economy, which is why the SDSE has been left fairly unregulated for the time being.

This may perhaps lead to your question: how can the government integrate the SDSE into the current economic infrastructure? Should the SDSE be regulated? Taxed? Subsidized? Well, not exactly.

You see, many investors and shareholders—including Loger, founding member of ROSE and major investor of GatoPoll who I interviewed for the research of this article, share a common sentiment in that taxing the stock exchange would lead to negative behavior from investors and may as a consequence halt trading all-together. Loger also believes that there is no need for legislation amidst the current volume of trade.

Advertisement

This raises a significant question: how can the government integrate SDSE into the economy without stifling its growth? The point I’m trying to make is that the investors, like Logan, believe that a poorly implemented or restrictive implementation of legislations and policies is destructive to the stock exchange and the fall of the stock exchange may attribute a large loss in circulation and monetary flow for the economy as a whole.

The Treasury acknowledges the importance of tax reforms and legislation, but insists that they must be based on thorough research and long-term data rather than rushed policies. Implementing policies in a haste would not only cause public distress but also damage the already fragile economic infrastructure currently present.

Secretary of Treasury Matt Cheney has emphasized in an interview that I conducted with him that he will not be making a decision in regards to regulating the SDSE without solid concrete evidence and data that suggests otherwise, stating:

“People will always say that something that affects their bottom line will be bad, but you have to weigh that against how much it could help the economy and real data detailing how it would affect investors. I completely understand why people would have that concern but until there’s evidence that is the case I am not going to make a decision on it either way.”

The future of the SDSE remains unwritten, but one thing is crystal clear—it is no longer a side project or an isolated financial experiment. It has become a force within the economy, a system that channels capital, drives investment, and provides opportunities where none existed before.

Only time will tell how our economy will evolve—but one thing is certain: the SDSE plays a crucial role in its growth. The question is no longer whether the SDSE is relevant but how best to harness its potential without stifling its growth. And in that regard, the SDSE has already succeeded—it is no longer a matter of how it will shape the economy, but more so a matter of how far it will go.